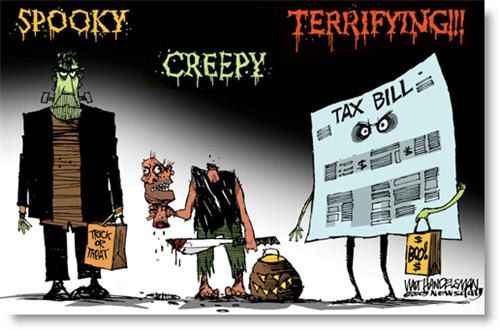

It’s an event that even scares my mail carrier. It terrifies most people – and small business owners are in their sights.

A letter from the IRS (or other taxing authority).

It so seldom conveys good news.

Whether it is sent regarding payroll or income taxes, getting a letter from the IRS scares most people.

Is it really that scary, though?

Open it.

Review what’s in it. What does it say? What tax period does it cover? Skip the scary parts – you know, the threats to lien your property. Don’t even read that part, we’re not there yet.

IRS letters usually are sent out because something should have been filed or wasn’t; funds were owed to another government entity (think student loans or child support) and the refund was garnished to pay for it; to notify you of a change in your tax return or credits; or to notify you of an audit.

They are sent in a specific order, from informative to threatening. It’s best to deal with these letters head-on.

Incidentally, neither the IRS nor Social Security will EVER call you. They will skip straight from letters to an agent at the door. If you get a phone call from the IRS, it’s a scam.

Anyway, to deal with these in order.

If something should have been filed but wasn’t, file immediately. Often this is due to a zero-due return. You should have filed quarterly payroll taxes (or, if the letter is from your state, a sales tax return) but didn’t have employees. File the return with all zeros. They still want to see that it’s filed.

If you’re not going to have employees, then close your payroll tax account with both your state and the Federal government. (Same with sales tax – if you are not subject to sales tax, close that sales tax account. It causes drama and stress, which isn’t needed if you’ll never have a taxable sale.)

If you were expecting a refund on your income tax return, but you or your spouse owe old child support or student loan obligations, the refund amount may have been taken to pay those obligations. Be thankful that your balance is being paid down as painlessly as possible. While there is an injured-spouse claim that you can file, I advise against it, as you shouldn’t be using your tax refund as a savings account anyway. Treat it as “free” money and let it pay your obligations so you can get that over with sooner. This letter is for your information.

Changes on your tax return/credits? It depends on what this is. During 2020 and 2021, the government allowed child tax credits to be sent to qualifying families. I highly discouraged accepting these funds, as it always comes back to bite you. Along those lines, several families I did taxes for did not declare receiving stimulus funds or advance child support payments to me, and got mad later when the IRS changed their refunds. Just because you didn’t tell your preparer, doesn’t mean the IRS doesn’t know! These families should have gotten several letters – notifying them that they were eligible for, but could decline, the advance child tax credit, and then notifying them of all funds received in 2020/21 in government stimulus.

I guarantee you, the IRS knows what they sent you. Trying to hide it from your preparer is not a good idea. At this point, the odds are that the return has already been filed, so you may receive a letter explaining that your refund has been reduced because you already received part of it.

Finally, the especially dreaded audit letter.

If you got one of these, let’s unpack it a bit. First, an audit means that they are looking at your tax return and have some questions. They want you to verify some information.

Did you claim the EITC (Earned Income credit)? You may need to prove that you and/or your children were in the US for more than 6 months of the year and/or that your qualifying children lived with you for more than 6 months.

Do they think you understated your income? Be prepared to prove what you earned. They will look at bank accounts as well as tax returns.

Audits sound scary, but what they are actually doing is verifying your information and making sure you didn’t try to claim anything crazy, like escort services, as a business expense.

So relax! It’s a pain, but if you follow the rules, and stay in communication, you’ll be fine.

Donna Harris holds a BSci in Accounting and is the owner of Bookkeeping Made Simple.

Donna Harris

Owner

Donna Harris, BSci Accounting, MBA, founded Bookkeeping Made Simple with the understanding that small businesses is the heart of the American economy. After offering to do books for a friend who said he didn't have enough work to keep someone in the office 20 hours a week, she recognized the need for an efficient, online system. She has 20 years of bookkeeping and accounting experience and is excited to help small business owners achieve their goals. She enjoys spending time with her family and traveling whenever possible. She also loves reading, hiking, camping, cooking, yoga, and fitness. A huge believer in lifelong education, she is currently working on her master's in Accounting.